Pillar 3a is a key element of Switzerland’s retirement system, offering individuals a smart and tax-efficient way to save for the future.

By allowing contributions to be deducted from your taxable income and enabling tax-deferred growth, it provides both immediate and long-term financial benefits.

For employees, it complements the state and occupational pensions, while for the self-employed, it can serve as their primary retirement savings vehicle.

With significant changes for 2025, including the introduction of retroactive buybacks, understanding how to maximise your Pillar 3a has never been more crucial.

Switzerland has one of the most robust social security systems in the world. Through a combination of social insurance schemes, supplementary benefits, and social assistance, the country ensures a wide safety net to prevent economic hardship and poverty.

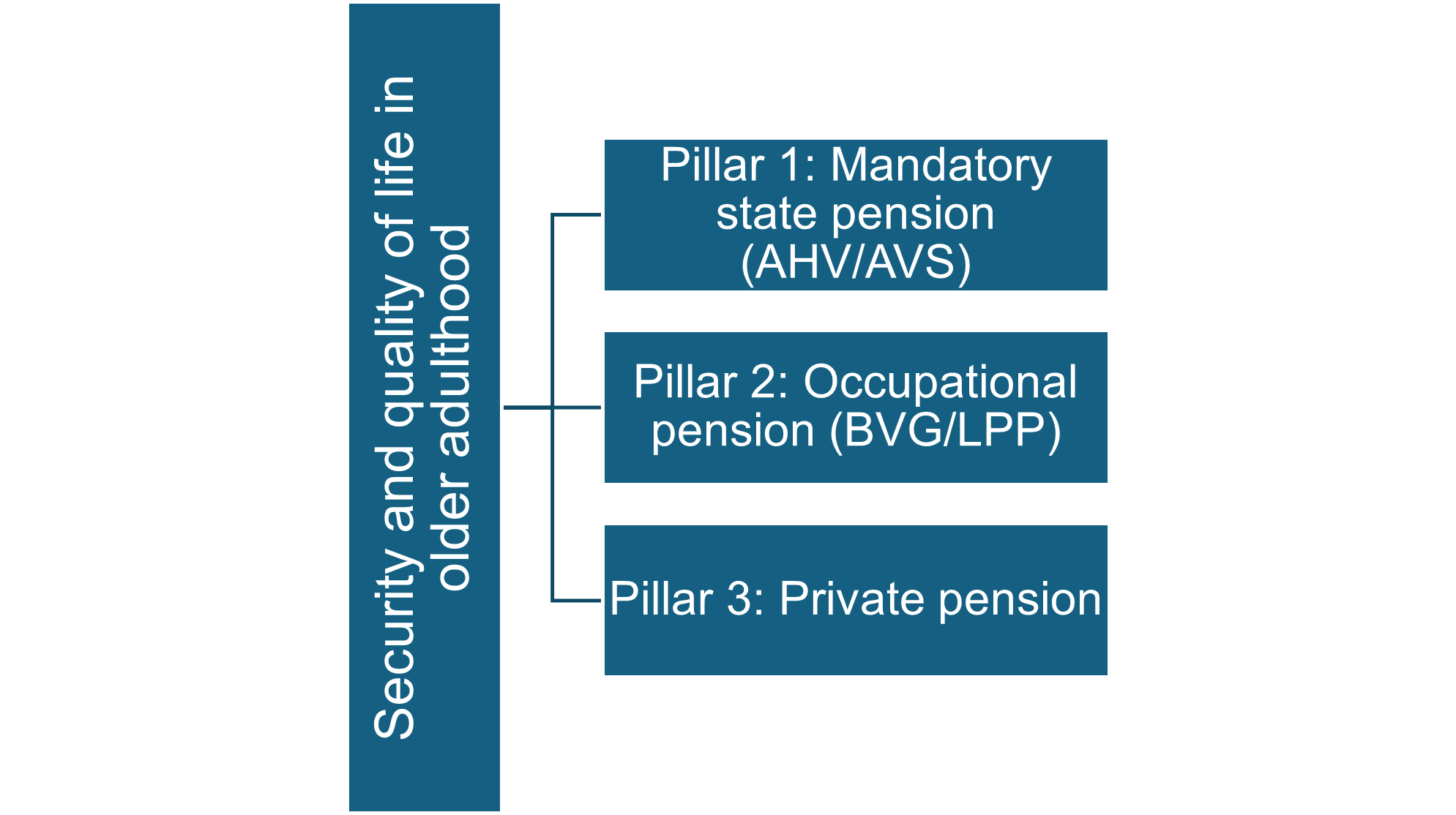

At the heart of this system is the retirement provision system, designed to guarantee that people can maintain financial independence and a decent standard of living even after they stop working. However, the structure of this system is more complex, as it is built on three distinct pillars, each with different roles, funding methods, and managing institutions.

This comprehensive guide focuses on the third and most flexible of these: the private pension, specifically the tax-privileged Pillar 3a.

We will explore how this powerful tool can secure your retirement while offering significant, immediate tax savings.

Before diving into Pillar 3a, it’s essential to see where it fits. The Swiss pension model is built on three pillars:

This article focuses on Pillar 3a, the tied private pension, which is especially beneficial for those looking to improve their retirement situation while saving on taxes.

Pillar 3a is a voluntary, tax-privileged retirement savings scheme. It is designed to complement the mandatory Pillars 1 and 2, helping individuals cover any pension gaps and ensure financial comfort in retirement.

If you would like to know more about the Swiss pension system click here

The defining features of Pillar 3a are straightforward and powerful:

The most immediate and compelling advantage of Pillar 3a is the annual tax saving. Every franc you contribute directly reduces your taxable income for that year.

For example, if you have a taxable income of CHF 120,000 and you contribute the maximum of CHF 7,258 to your Pillar 3a, your taxable income is instantly reduced to CHF 112,742. You are taxed on the lower amount, resulting in a direct saving that can often amount to 20-35% of your contribution, depending on your canton and income bracket.

Estimated Annual Tax Savings with the Maximum Pillar 3a Contribution

These are estimates based on an unmarried individual with no children. Actual savings depend on your canton, municipality, and personal tax situation.

Taxable Income | Max Contribution (with Pillar 2) | Estimated Tax Saving |

CHF 80,000 | CHF 7,258 | ~ CHF 1,600 – 1,800 |

CHF 120,000 | CHF 7,258 | ~ CHF 2,200 – 2,500 |

CHF 160,000 | CHF 7,258 | ~ CHF 2,800 – 3,100 |

Understanding Pillar 3a is easier when you appreciate the historical context and stability of the entire Swiss pension system.

It wasn’t created in a vacuum; it was the thoughtful culmination of nearly a century of social and economic planning.

The foundations of Switzerland’s retirement system were laid nearly a century ago, reflecting the country’s long-standing commitment to social security and economic stability.

The first major step came on December 6, 1925, when the Swiss people and cantons voted overwhelmingly in favor of a new constitutional article that called for the creation of a national old-age and survivors’ insurance system.

However, it was not until 1947 – after two decades of planning and debate – that the law establishing the Old-Age and Survivors’ Insurance – known as AHV (Alters- und Hinterlassenenversicherung) in German and AVS (Assurance-vieillesse et survivants) in French – was finally adopted by public vote. (you can see the full historical timeline here)

The first pensions were paid out in January 1948, with monthly benefits ranging from just 40 to 125 Swiss francs – a modest but groundbreaking beginning.

Over the decades, the system evolved in response to demographic changes, rising life expectancy, and shifts in the labor market.

The introduction of the second pillar – the occupational pension, known as BVG (Berufliche Vorsorge Gesetz) in German and LPP (Loi sur la prévoyance professionnelle) in French – in 1985 made it mandatory for employers to offer workplace pensions, helping employees maintain their standard of living after retirement.

Two years later, in 1987, the government introduced Pillar 3a, the tied individual pension, as a voluntary supplement to the first two pillars. Its purpose was clear: to give working individuals – especially the self-employed and those with income gaps – an opportunity to strengthen their retirement savings while benefiting from attractive tax deductions.

Today, Pillar 3a plays a crucial role in enabling people to prepare more independently for retirement, and recent reforms, such as the 2025 buyback option, continue to make it more flexible and accessible.

The three-pillar system as a whole reflects a carefully balanced model that combines state responsibility, employer contributions, and individual initiative – making Switzerland’s pension system one of the most stable and respected in the world.

Do You Need Help With Your Pillar 3a?

A significant and welcome change is coming to Pillar 3a regulation.

Starting January 1, 2025, the Swiss government allows retroactive contributions (‘buybacks’) into Pillar 3a. If someone did not make the maximum contribution in previous years, they can now make up for it – up to 10 years back.

This change responds to a long-standing political request and gives individuals more flexibility in optimizing their retirement planning and tax situation.

Conditions for buybacks:

The main advantage is clear: All retroactive contributions are fully tax-deductible, just like ordinary contributions.

"The 2025 buyback option is more than just a catch-up mechanism; it's a strategic financial planning tool.

Imagine you've just received a large bonus, sold a property, or finished paying for your children's education. This new rule allows you to use that surplus capital to make a significant, tax-deductible contribution, effectively reducing a large tax bill in a high-income year while simultaneously boosting your retirement savings. It's a win-win."

To make an informed decision, it’s crucial to look at both sides of the coin.

Pros of Pillar 3a | Cons of Pillar 3a |

✅Significant Tax Savings: Deduct contributions directly from your taxable income. | ❌ Restricted Access: Funds are tied until five years before official retirement age, with few exceptions. |

✅ Tax-Deferred Growth: Your investments grow free from annual income or wealth tax. | ❌ Taxed on Withdrawal: The full capital amount is subject to a one-off tax upon payout, albeit at a reduced rate. |

✅ Disciplined Long-Term Saving: The ‘tied’ nature prevents impulsive spending and encourages consistent wealth building. | ❌ Contribution Limits: You cannot contribute more than the legally defined maximums each year. |

✅ Flexible Use for Home Ownership: Can be withdrawn early to purchase a primary residence. | ❌ Inflation Risk on Cash: Funds left in simple savings accounts may not outpace inflation over the long term. |

There are two recognized types of 3a products: a Pillar 3a account with a bank or a Pillar 3a insurance policy.

The choice between them is fundamental and depends entirely on your personal needs for flexibility, security, and growth.

Pillar 3a account with a bank or digital provider (e.g., savings or investment accounts). These solutions are ideal for those prioritising flexibility and potential returns.

You can decide how much to contribute each year (up to the maximum) and can often choose to invest your funds in a portfolio of securities.

This offers higher growth potential over the long term but comes with market risk. Bank-based 3a solutions are more flexible and usually lower in fees.

Pillar 3a insurance policy with an insurance company (includes risk coverage or guaranteed returns).

These products are suited for individuals who value security and wish to combine their retirement savings with insurance coverage, such as life or disability insurance. You typically commit to fixed annual premiums.

Insurance-based ones offer death and disability coverage but often come with longer commitments and less flexibility.

Although normally locked until retirement, Pillar 3a funds can be withdrawn early in the following cases:

Each of these scenarios has specific legal requirements that must be met.

This is a critical aspect of estate planning. In the event of death, the 3a assets are distributed in a legally defined order:

You can request adjustments within this order, especially to include a partner, but only under specific legal rules.

Start early: The earlier you contribute, the more your savings grow thanks to compound interest. Even small amounts contributed in your 20s can grow to be larger than significant sums contributed in your 40s.

Review providers: Compare fees, performance, and flexibility (especially for bank-based 3a products). High fees can erode your returns over time.

Plan for withdrawal: Spread 3a payouts over multiple years if possible to reduce tax impact. A common strategy is to open a new Pillar 3a account every 5-7 years, allowing you to withdraw one full account each year in retirement, keeping you in a lower tax bracket.

Do You Still Have Question About Pillar 3a?

Yes, and it is a highly recommended strategy.

Opening several accounts (e.g., up to five) allows you to stagger withdrawals over several years in retirement.

This breaks the total payout into smaller amounts, which can significantly lower the overall progressive tax rate you pay on the withdrawals.

With a bank solution, nothing happens; you simply contribute less for that year.

Before 2025, that contribution potential was lost forever.

From 2025, you have the option to make up for missed years via the ‘buyback’ rule.

With an insurance solution, missing a contractually obligated premium may have consequences, so it’s best to check your policy.

It is subject to a one-off capital withdrawal tax.

This is calculated separately from your regular income tax and at a much lower, progressive rate.

The exact rate depends on the total amount withdrawn in a single year and your canton of residence at the time.

Pillar 3a is ‘tied’ pension provision. It has strict rules, contribution limits, and withdrawal conditions, but in return, it offers significant tax deductions.

Pillar 3b is ‘flexible’ private saving (e.g., regular savings accounts, stocks, non-primary property). It offers no tax deductions on contributions but has complete flexibility on access and use.

They serve different but complementary purposes in a holistic wealth plan.

Pillar 3a is a key element of Switzerland’s retirement system, offering individuals a smart and tax-efficient way to save for the future. By allowing contributions to be deducted from taxable income and enabling tax-deferred growth, it provides both immediate and long-term financial benefits. For employees, it complements the state and occupational pensions, while for the self-employed, it can serve as their primary retirement savings vehicle.

The flexibility of Pillar 3a also makes it attractive. While the funds are tied until retirement, early withdrawals are possible for major life events like buying a home or becoming self-employed. With recent legal changes allowing retroactive contributions, savers now have even more opportunities to optimize their tax situation and catch up on missed savings.

In summary, Pillar 3a is more than just a savings account – it is a powerful planning tool that helps ensure financial security in retirement. Whether you are just starting your career or already planning your retirement strategy, making regular use of Pillar 3a can make a significant difference in your financial future.

Let’s build a plan that aligns with your specific goals and maximises your tax savings for years to come.

Get notified about new articles, latest changes and much more