Moving from Switzerland to Spain? Don’t trigger the “Pension Trap.”

While Spain’s lifestyle is attractive, its tax system can be a shock for Swiss expats.

From the Beckham Law to the Solidarity Tax, we explain the critical differences between Swiss and Spanish fiscal rules. plus, discover the compliant investment vehicle that can legally lower your investment tax rate to under 6%, no matter your wealth level.

Spain continues to attract professionals, entrepreneurs, and retirees from around the world thanks to its lifestyle, climate, and strategic position within Europe.

For residents of Switzerland, the UK, or the USA, the allure of Spain is undeniable. However, relocating implies moving from one fiscal jurisdiction to another with vastly different rules. For Swiss residents specifically, moving from a system of lump-sum taxation or lower income tax to the Spanish system requires careful navigation.

Here is an overview of the key points to consider before making the move, including the Beckham Law, the Swiss pension trap, and compliant investment solutions.

You become a Spanish tax resident after spending more than 183 days in Spain per calendar year. As such, you are liable for tax on your worldwide income and assets.

Unlike Switzerland or the UK, Spain does not generally offer a “split-year” treatment. If you spend more than half the year in Spain, you are resident for the whole year.

The income tax (IRPF) is progressive, with top marginal rates reaching around 45-54% depending on the specific autonomous region (e.g., Valencia, Andalusia, Madrid).

The good news is that if you have not been considered a Spanish tax resident in the previous five years, you can apply for a Special Expat Tax Regime, commonly known as the Beckham Law.

The Beckham Law allows qualifying individuals who move to Spain for work to be taxed only on Spanish-source income for up to six years (the year of registration + 5).

To apply, you must fulfil several conditions. You must relocate to Spain for employment or to take an executive role in a Spanish company. Note that recent changes (the Startups Law) have expanded this to include Digital Nomads and teleworkers under specific circumstances.

The application must be filed within six months of registering with Spanish Social Security. This regime can significantly reduce the tax burden for international professionals.

Depending on your personal situation, you may wonder: What if I am retired or will be soon? Or What about the capital I have built up in Switzerland?

For those moving from Switzerland, there is a specific nuance regarding Pillar 2 (Occupational Pension) and Pillar 3 (Private Pension). You can read more about how the pension system in Switzerland functions here.

If you cash in these pensions after you become a Spanish tax resident, Spain may treat the lump sum as general income. This could push you immediately into the top tax bracket (up to 54%).

Is there nothing retirees or investors can do to reduce their tax burden if they don’t qualify for the Beckham Law?

Don’t worry, in this case, there are also huge saving opportunities.

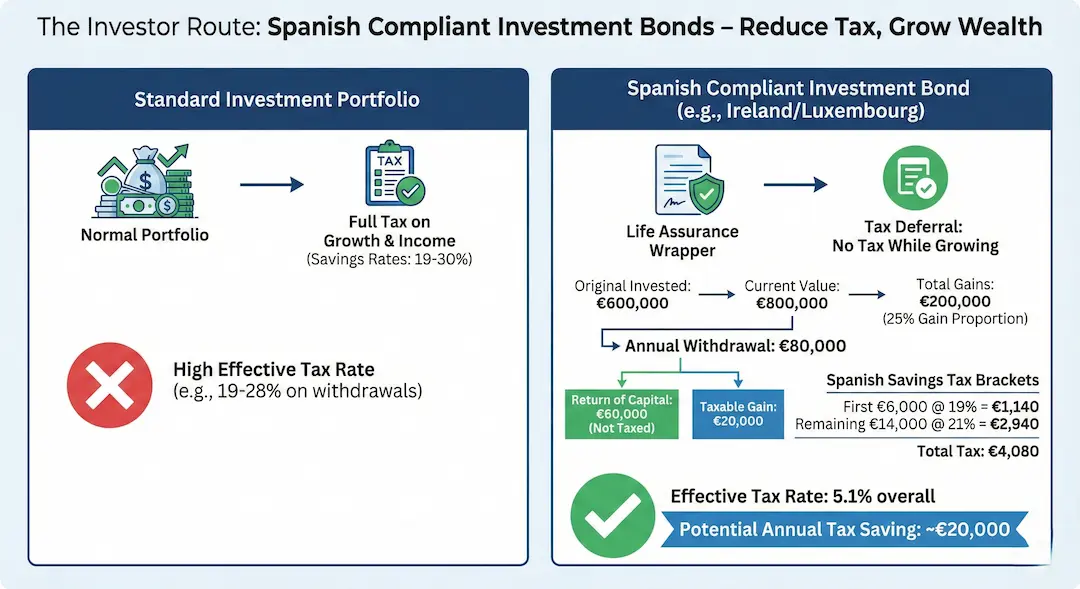

Pensions and standard investment portfolios are normally taxed at the savings or general IRPF rate. But there are certain products based on specific jurisdictions; known as Spanish Compliant Investment Bonds (often domiciled in Ireland or Luxembourg), that allow us to receive income at a much lower rate.

These are life assurance policies that act as investment wrappers. They offer tax deferral (you pay no tax while the money grows inside) and proportional tax relief upon withdrawal.

Let’s see an example of how it would work with one of these products:

Spain only taxes the gain proportion of each withdrawal. The tax calculation goes as follows:

Taxable portion = Withdrawal × (Total gains ÷ Total value)

Here:

So, for an €80,000 withdrawal:

Spain taxes investment income, including the gains of this example, at the following state rates:

Capital Gain Amount (€) | Tax Rate (%) |

Up to 6,000 | 19% |

6,001 to 50,000 | 21% |

50,001 to 200,000 | 23% |

200,001 to 300,000 | 27% |

Above 300,000 | 30% |

Considering these tax brackets, if this €20,000 gain is your only savings income that year:

Effective tax rate: €4,080 ÷ €80,000 = 5.1% overall.

Not bad considering that, at the normal rate, it would be taxed significantly higher.

Translating to numbers, you could save €20,000 per year on taxes in this case compared to a standard bank portfolio.

Hans (62) moves from Zurich to Valencia with €1M in savings.

Scenario A: The “Do It Yourself” Approach

Hans keeps his money in a Swiss bank (Credit Suisse or UBS) and moves to Valencia.

Scenario B: The Wealth Management Approach

Hans moves his capital into a Spanish Compliant Investment Bond (via Luxembourg) before becoming a resident.

Time to move on to a different kind of tax: Capital Gains and Solidarity Tax.

As shown before, capital gains from the sale of shares, funds, or property are taxed as savings income at rates between 19% and 30%, depending on the amount.

Additionally, Spain has a Solidarity Tax, which applies to net assets above €3M (+700k as a general exemption + 300k exemption for the main residence). This can be troublesome for some high-net-worth individuals, considering that when the net worth is over €10M, the rate is 3.5%.

However, there is a number of exemptions that can be considered depending on the specific situation of each individual.

For example, the Madrid and Andalusia regions currently effectively subsidise 100% of the Wealth Tax (though the national Solidarity Tax may still apply to very high net worths).

Another of the most concerning tax events is inheritance. In this regard, some regions offer exemptions of up to 99% for Groups 1 and 2 (husband/wife, ascendants, descendants, and adopted). This applies in regions like Madrid, Andalusia, and the Valencian Community.

In general, Groups 1 and 2 often have a tax reduction, but even after the reductions, the difference between regions can be more than €100k for a €1M inheritance.

Crucial for Expats: While being in one of those regions will be very beneficial, beware that other countries might tax you as well. For instance, if you were a UK resident for many years, you would still be considered UK-domiciled for Inheritance Tax purposes.

Generally, no.

The Beckham Law is designed for employees.

However, the new Startups Law has opened pathways for entrepreneurial activity and specific high-qualified professionals.

This requires a specific analysis of your business setup.

Yes.

Spain and Switzerland are signatories to the Common Reporting Standard (CRS).

Financial information is automatically exchanged between the two countries.

Relying on secrecy is a dangerous strategy that leads to severe fines.

It is an informative declaration of assets held abroad.

If you live in Spain and have more than €50,000 in any category of asset outside Spain (Bank accounts, Investments, Property), you must declare it.

The Spanish Compliant Bond can often help bypass this reporting requirement legally.

Yes.

Cryptocurrency gains are taxed as savings income (19-28%). Spain also has a specific declaration form (Modelo 721) for crypto assets held abroad.

Moving to Spain offers an exceptional lifestyle, but for Swiss residents, it presents a stark fiscal reality: you are moving from a system of subtle wealth taxation to one of the most complex tax regimes in Europe.

As we have seen, the difference between a standard relocation and a strategically planned one is not merely administrative, it is financial. A “DIY” approach can lead to unnecessary exposure to the Spanish Wealth Tax, the immediate taxation of Swiss pension capital, and the rigorous reporting requirements of the Modelo 720.

However, with the correct use of the Beckham Law for executives or Spanish Compliant Investment Bonds for retirees, Spain can become a tax haven in its own right. The tools exist to protect your wealth; the key is deploying them before you become a tax resident.

Your journey to Spain should be defined by the sun and the culture, not by unexpected tax bills. Secure your financial peace of mind today.

Get notified about new articles, latest changes and much more