Unlock the complexities of Switzerland’s world-renowned pension system.

This comprehensive 2025 guide explains precisely how the Swiss pension system works through its robust three-pillar model, from state-backed essentials to personalised private provisions, helping you strategically optimise your retirement security in Switzerland.

Switzerland’s pension system stands as a global benchmark for stability, sustainability, and its balanced approach to retirement provision.

Designed to provide comprehensive financial security throughout retirement while also covering crucial risks like disability and death, it’s built upon a unique three pillar model.

For residents, employees, and expats in Switzerland, understanding how the Swiss pension system works is not just about compliance, it’s about strategically optimising your financial future.

This comprehensive guide will demystify the system, explain each of its pillars, highlight key changes for 2025, and show you how to maximize your retirement savings.

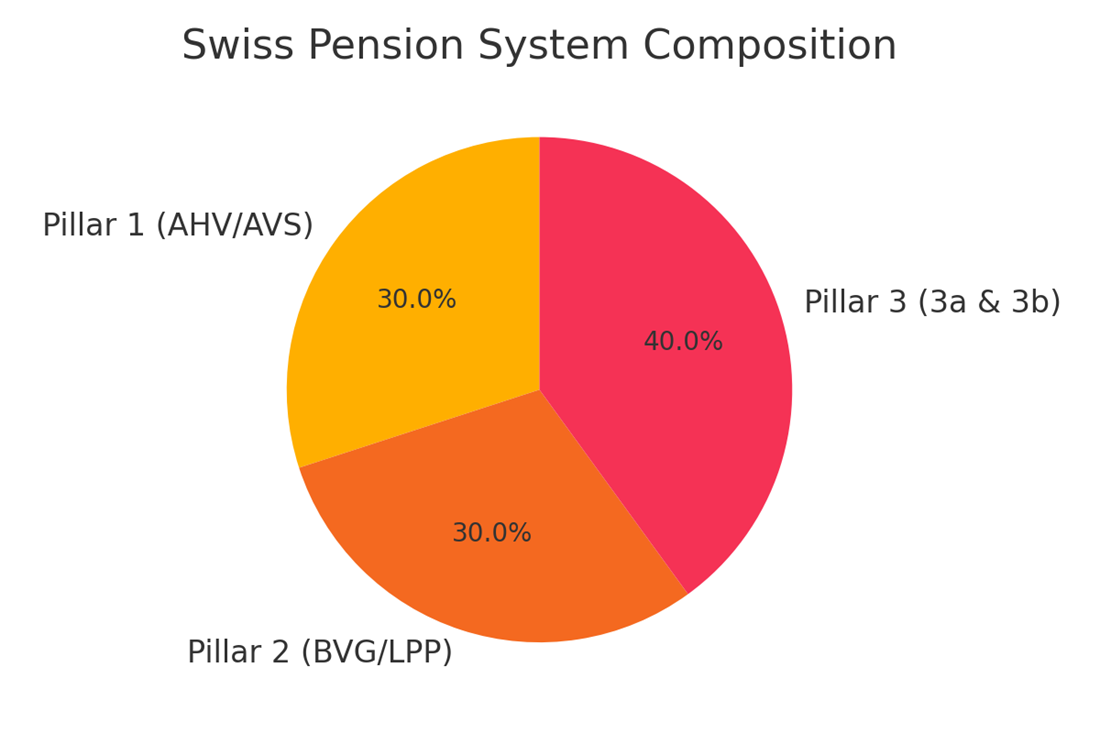

The Swiss pension framework is intentionally diversified across three complementary “pillars,” each with a distinct role, funding logic, and tax treatment.

Together, they provide resilience against longevity risk, disability, and premature death, while giving individuals significant freedom to optimize their own retirement capital.

Why Three Pillars? The system’s design aims to balance collective solidarity with individual responsibility.

Let’s explore each pillar in detail:

| Pillar | Core Role | Funding Source |

|---|---|---|

| 1 – State (AHV/AVS) | Prevent poverty; cover basic needs | Pay-as-you-go payroll tax (solidarity principle) |

| 2 – Occupational (BVG/LPP) | Maintain pre-retirement living standard | Capital-funded by employers & employees |

| 3 – Private (3a & 3b) | Close gaps, offer flexibility & tax planning | Voluntary individual savings |

The Big Idea: The state ensures a floor, employers help you keep your lifestyle, and you decide how much extra security or growth you want on top.

The bedrock of the Swiss pension system, Pillar 1 aims to provide a minimum subsistence income in retirement or if breadwinners die/become disabled.

It operates on a “pay-as-you-go” principle, meaning current contributions fund current pensions.

| Scheme | Total | Employee | Employer |

|---|---|---|---|

| AHV | 8.7 % | 4.35 % | 4.35 % |

| IV | 1.4 % | 0.7 % | 0.7 % |

| EO | 0.5 % | 0.25 % | 0.25 % |

| Combined | 10.6 % | 5.3 % | 5.3 % |

Self-employed individuals typically pay a total of 10% on their income, while non-employed individuals pay a fixed annual contribution (e.g., CHF 530–26,500 in 2025) depending on their wealth and income.

The second pillar, also known as the occupational pension scheme, works alongside Pillar 1 to maintain your pre-retirement standard of living. It’s a capital-funded system, meaning contributions are saved and invested for your future.

| Age | Total Rate | Employee 5 % Track | 7.5 % Track | 10 % Track |

| 25–34 | 7 % | 5 % emp / 5 % er | 7.5 % emp / 5 % er | 10 % emp / 5 % er |

| 35–44 | 10 % | … | … | … |

| 45–54 | 15 % | … | … | … |

| 55–65 | 18 % | … | … | … |

| (er = employer, emp = employee; figures illustrative) | ||||

The third pillar is voluntary and designed to close any pension gaps left by Pillars 1 and 2, allowing you to maintain your desired lifestyle in retirement and achieve personal financial goals.

It’s divided into two components: Pillar 3a (tied and tax-deductible) and Pillar 3b (flexible).

Pillar 3a is highly attractive due to its significant tax benefits, making it an essential tool for effective retirement planning in Switzerland.

You can find out more about Pillar 3a here in our dedicated article.

Pillar 3b offers maximum flexibility for your private savings, allowing you to invest without strict government regulations, though with different tax implications.

Understanding the differences between the pillars is key to building a cohesive strategy and getting to understand how soes the Swiss pension system work.

Feature | Pillar 1 (AHV/AVS) | Pillar 2 (BVG/LPP) | Pillar 3a | Pillar 3b |

Mandatory? | ✅ All residents | ✅ Employees > CHF 22,680 | ❌ Voluntary | ❌ Voluntary |

Tax-deductible input? | ❌ (payroll deduction) | ✅ (salary deduction) | ✅ (limits apply) | ❌ (limited exceptions) |

Access before retirement? | Very restricted | Restricted (e.g., home purchase, emigration) | Conditional (e.g., home purchase, self-employment, emigration) | Anytime |

Investment control? | None | Low (managed by pension fund) | Medium (choice of funds/insurance) | High (individual choice) |

Creditor protection? | Very high | High | High | Normal |

Still Unsure How The Swiss Pension System Works?

Optimising your Swiss pension strategy involves a thoughtful approach to allocating your savings across the pillars.

These are some of the Decision Factors you should consider for your pension strategy in Switzerland:

Scenario | Best Tool(s) |

High marginal tax rate, need deductions | 3a → BVG boost |

Saving for an early home purchase | 3a (conditional) + 3b |

Seeking highest long-run return, comfortable with risk | 3b ETFs/Investment Funds |

Close to retirement, want guaranteed pension | BVG boost / Annuities |

Expat planning to leave Switzerland | Pillar 3a (for early withdrawal options) + Pillar 3b |

Desire for maximum flexibility and access to capital | Pillar 3b |

Many individuals are surprised to learn that Pillars 1 and 2 alone often do not provide enough income to maintain their desired lifestyle in retirement.

Here’s a simplified illustration of the potential retirement-income “gap” for someone on a net salary of CHF 12,000 per month (approx. CHF 144,000 net, ~CHF 170,000 gross), assuming they rely only on Pillar 1 (AHV/AVS) and the mandatory part of Pillar 2 (BVG) and do not build any Pillar 3 savings.

| Item | Assumption | Comment |

|---|---|---|

| Age / career | 25 – 65 (40 full contribution years) | Gives full AHV entitlement |

| Gross salary | ≈ CHF 170,000 | Implied from CHF 12,000 net (very rough) |

| Insured BVG salary | CHF 64,260 (90,720 – 26,460) | Legal maximum for mandatory plan (2025 figures) |

| Employee track | 5 % (employer also 5 %) | Mondelez base plan example |

| Average total BVG rate | 10 % of insured salary | 5 % employee + 5 % employer |

| BVG net yield | 2 % p.a. | Typical long-run net return in a conservative mandatory fund |

| Conversion rate | 6.8 % | Legal BVG rate applied at retirement |

| Source | Annual Pension (CHF) | Monthly (CHF) |

|---|---|---|

| Pillar 1 (AHV) | 30,240 (max: 2,520 × 12) | 2,520 |

| Pillar 2 (BVG mandatory) | ~ 27,200 | ~ 2,270 |

| TOTAL (1 + 2) | ≈ 57,440 | ≈ 4,790 |

How the BVG figure was derived:

With no Pillar 3a or 3b savings, the retiree in this scenario would replace only ~40% of their net income—far below the ~60% standard Switzerland targets, and even further from their current lifestyle. This illustrates precisely how the Swiss pension system works to create a potential shortfall if not proactively managed.

| Metric | Amount |

|---|---|

| Current net salary | CHF 12,000 / month |

| Projected Pillar 1 + 2 income | CHF 4,790 / month |

| Monthly shortfall (“gap”) | ≈ CHF 7,210 |

| Annual gap | ≈ CHF 86,520 |

| Action | Potential Effect |

|---|---|

| Max Pillar 3a (CHF 7,258 p.a.) | Tax-deductible; after 25 years at 4% could add ~CHF 14,000 p.a. (≈ 1,200 / month) |

| BVG buy-in / 10% track | Larger pension factor, creditor-protected; adds ~CHF 9,000 – 12,000 p.a. |

| Pillar 3b portfolio (ETF 5% p.a.) | Fully flexible; CHF 1,000 / month over 25 years could generate capital of ~CHF 600,000 → extra CHF 24,000 p.a. at 4% drawdown |

Combined, these measures can raise retirement income into—or even above—the 60%–70% replacement zone, effectively bridging the retirement gap.

Do You Have Questions About The Three Pillar System?

The system aims to provide financial security in old age, disability, and death. Pillar 1 covers basic needs, Pillar 2 maintains a accustomed lifestyle, and Pillar 3 allows for individual optimization and closing any remaining income gaps.

Pillar 1 (AHV/AVS) is mandatory for all residents and gainfully employed individuals in Switzerland. Pillar 2 (BVG/LPP) is mandatory for employees earning above a certain threshold. Pillar 3 is entirely voluntary.

Yes.

Anyone residing or working in Switzerland contributes to and benefits from the system. Special rules apply for cross-border commuters and those emigrating, particularly regarding the withdrawal of Pillar 2 and 3 funds.

Pillar 3a is a “tied” pension provision offering significant tax deductions on contributions and tax-free growth, with withdrawals restricted to specific conditions (retirement, home purchase, self-employment, emigration, disability, death).

Pillar 3b is a “flexible” savings vehicle with no upfront tax deductions on contributions but offers unlimited flexibility in terms of access and investment choice.

From January 1, 2025, individuals can make retroactive contributions into Pillar 3a to close gaps from up to the past ten years.

These retroactive payments are fully tax-deductible, provided the maximum annual contribution for the current year has been made and AHV-liable income was earned in the back-paid year.

For a full contribution period, the minimum monthly pension in 2025 is CHF 1,260, and the maximum is CHF 2,520 for a single person.

Married couples’ pensions are capped at 150% of the maximum single pension (CHF 3,780/month).

Generally, Pillar 2 funds are tied until retirement.

However, early withdrawals are typically permitted for specific reasons such as purchasing a primary residence, becoming self-employed, or permanently emigrating from Switzerland.

The three-pillar logic balances security with flexibility, ensuring a comprehensive safety net.

Pillar 1 (AHV/AVS, 10.6%) and unemployment insurance (ALV/UI, 2.2%) are statutory and largely fixed; BVG (Pillar 2) and Pillar 3 are where you can strategically optimize your retirement.

Increasing BVG contributions offers strong protection and tax deductions but is least liquid. Pillar 3a mixes significant tax perks with moderate flexibility and the new retroactive contribution opportunity for 2025 is a game-changer. Pillar 3b provides total freedom but no upfront tax relief.

Action Step: Check your annual pension certificate, fill your 3a allowance (and consider retroactive payments for past years), then decide whether a BVG bump or a diversified 3b investment portfolio best matches your financial horizon and risk profile.

At Private Client Consultancy, we understand the intricacies of Switzerland’s three-pillar pension system. We go beyond generic advice, providing personalised, tax-efficient, and future-proof solutions tailored to your unique life stage, income, and retirement goals with peace of mind.

Competing with major banks means offering unparalleled expertise and a client-centric approach.

What we offer:

We help you leverage the full power of Pillar 3a, especially with the exciting 2025 changes:

Beyond the mandatory, we help you make informed decisions:

We design a Pillar 3b strategy that integrates with your broader financial aspirations:

For international clients, we offer specialized guidance:

Advantages you can find with Private Client Consultancy

Let us help you turn your pension system into a powerful financial asset.

Get notified about new articles, latest changes and much more