The 2025 Autumn Budget marks a significant shift in the UK’s fiscal landscape, moving from headline rate hikes to a strategy of ‘fiscal drag’ and targeted wealth taxation.

From the new ‘Mansion Tax’ and frozen income thresholds to the capping of pension salary sacrifice, this guide explores how the new measures specifically impact high-net-worth individuals, expats, and residents—and why a ‘passive’ investment strategy may no longer be enough to protect your wealth.

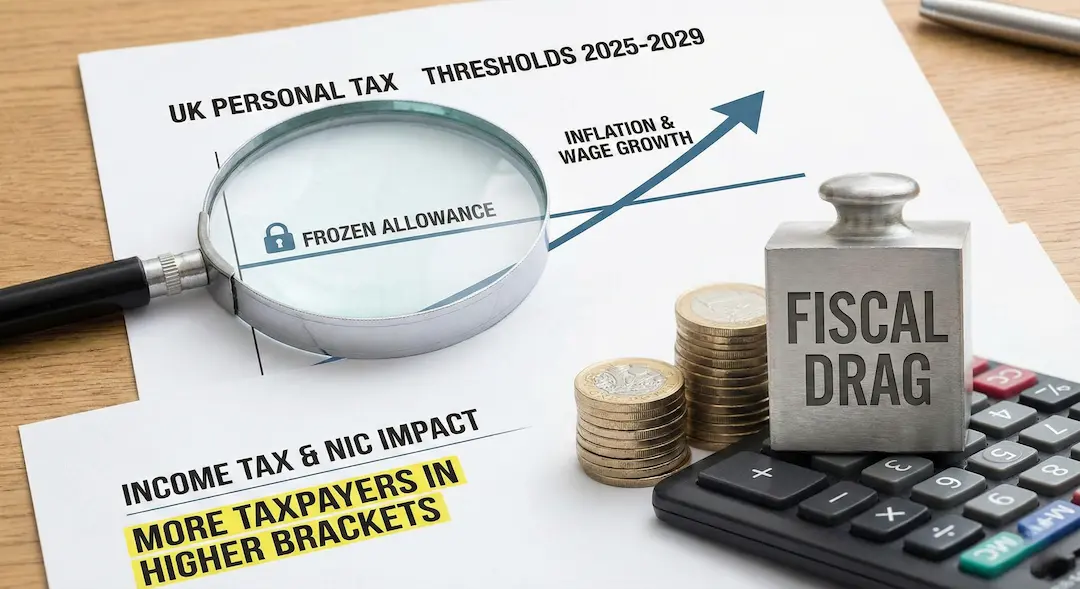

The 2025 Budget extends the freeze on personal income-tax thresholds (personal allowance, higher-rate thresholds) and NIC thresholds (employee/employer) for an additional three years — now covering at least until 2028-29. (Sky News)

With inflation and nominal wage growth, this “threshold freeze” results in fiscal drag: more taxpayers will get pushed into higher tax brackets even if their real (inflation-adjusted) income remains roughly constant. (The Guardian)

According to official forecasts, more than 1.7 million additional people will pay higher income tax as a result of the freeze. (Yahoo Finance UK)

The freeze is the single biggest revenue-raising measure: the government expects the personal tax + NIC threshold freeze to raise about £8 billion (on a recurring basis) by 2029-30. (Landlord Today)

Middle earners whose salaries increase (even modestly) may find themselves in a higher bracket — increasing their tax burden without an overt tax-rate hike.

Real disposable incomes will be under pressure over time, especially given inflation. Official forecasts now expect household disposable income growth to be much weaker than recently. (Financial Times)

Threshold freeze matters only while clients remain UK tax-resident or draw UK-sourced earned income. If they become non-resident and have no UK earned income, this is less relevant.

For clients with split residency or returning migrants, the freeze may affect timing of their return, compensation packages, and decisions on when to draw income.

Let's analyse your marginal tax rates, especially if you have rising incomes.

Let's consider whether salary increases or bonus timing could be optimized to minimize drag — e.g., deferring raises, or shifting compensation to capital distributions (if feasible and compliant).

If you are a globally mobile person: let's monitor your UK tax residency status closely; consider whether non-UK income or deferred UK-salary schemes may offer advantages.

One of the headline moves in the Budget concerns increases to the tax on unearned income (dividends, savings interest, property income). (Reuters)

Those relying on dividend income (e.g. owners of private companies, investment portfolios) will see reduced net after-tax returns after April 2026.

Landlords and property investors will face lower net yields: higher income tax on rental profits, with mortgage interest relief limited in its benefit.

Savings-oriented clients who rely on interest income or cash allocations will get hit — less attractive relative to before.

UK-resident expats or British citizens living abroad but retaining UK investment income (dividends, rental) will also be subject to higher rates — making UK-source unearned income less attractive.

For expatriates with diversified global portfolios: may wish to consider moving away from UK-sourced yields, or shifting toward non-UK domiciled assets, subject to domicile/residence status and legal/tax compliance.

Let us revisit your portfolio composition: maybe dial down UK dividend-heavy exposure, or shift toward growth-oriented (capital gains) rather than yield-heavy investments.

If you are a landlord we can run new cash-flow and yield analyses post-Budget; consider whether holdings remain viable under higher tax burden and lower net return.

Let us evaluate the attractiveness of alternative investment jurisdictions, offshore bonds or structures (where compliant), especially if you are internationally mobile.

The core personal allowance (the amount of income you can earn tax-free) remains, but because thresholds are frozen, its real-term value erodes over time. (Personal allowance currently approx. £12,570) (Wikipédia)

The Budget framing suggests that with more income being taxed (through dividend, savings, property income increases), the relative benefit of personal allowance diminishes for high-income and mixed-income individuals. (Tax Policy Associates)

For mixed-income clients (salary + dividends + savings), the personal allowance will cover a smaller portion of total income over time — increasing overall effective tax rates.

Strategic planning of income receipt becomes more important (e.g. when to draw dividends vs salary; what income to realize when).

We can explore whether distributing income among spouses (if applicable), or using trusts/family-office structures, may optimize use of allowances under the new regime.

The 2025 Budget does not appear to change these allowances. In publicly available Budget documents, no amendments to Married Couple’s Allowance or Blind Person’s Allowance were announced. (GOV.UK)

However, given threshold freezes and rising tax on unearned income, the real-value of all allowances will decline over time.

For clients who benefit from these allowances: they remain intact — but planning must account for real erosion of their benefit over time.

Encourage longer-term tax planning rather than reliance on allowances alone; consider how allowance erosion interacts with other income streams.

Would you like more specific details about your situation?

The Budget introduces a new council-tax surcharge on properties valued over £2 million, sometimes called a “mansion tax.” (Landlord Today)

Implementation is expected from 2028. (MoneyWeek)

Owners of high-value homes (residential properties worth more than £2M) or high-end real estate portfolios will face additional recurring costs on top of existing council tax and other expenses.

For clients using residential real estate as part of a wealth-holding or investment portfolio, this increases carrying costs and reduces attractiveness of UK residential real estate — particularly for those with multiple or luxury homes.

UK-based properties retained by Brits living abroad become more expensive to hold over time. Surcharges + higher property-income taxes could erode expected returns or make holding untenable.

Administrative burden and long-term costs may prompt reconsideration of holding UK residential real estate.

Reassess real estate holdings, especially high-value residential properties — run long-term cost/yield projections factoring in surcharge, tax increases, maintenance, occupancy risk.

If you have multiple homes or properties: consider consolidation, sale, or repositioning (e.g. converting to rental property vs keeping primary residence).

Explore diversification — non-UK real estate, real estate funds, commercial real estate, alternative real assets.

The Budget caps the amount of pension contributions via salary sacrifice that benefit from National Insurance (NI) exemption to £2,000 per year, starting in April 2029. (ftadviser.com)

Contributions above this cap will be treated as ordinary pension contributions — subject to the usual NI. (ftadviser.com)

The change is expected to yield roughly £4.7 billion additional tax/NIC revenue in 2029-30. (Reuters)

For many middle- and high-income earners who have used salary sacrifice to build pensions while minimizing NIC, this reduces a significant benefit. Take-home pay could drop, and pension accumulation may slow. (MoneySavingExpert.com)

For employers (especially of high earners), the cost of offering generous pension contributions increases — a factor that may influence employer pension policy, contribution matching, or bonus structuring. (Reuters)

For UK-based expats or internationally mobile clients still using UK-based pension schemes, the cap reduces the attractiveness of UK pension contributions via salary sacrifice.

For globally mobile persons, this may tilt the balance toward private pensions, offshore pension wrappers, or foreign pension schemes — depending on domicile/residence.

For clients nearing 2029: consider front-loading pension contributions before cap applies (if allowed), or revising pension strategy (e.g. contributions outside salary sacrifice, use of other pension vehicles, diversification).

You should re-evaluate employer pension schemes — check whether your employer intends to revise benefits, matchings, or move to alternative arrangements.

For international situations compare UK pension benefits vs private/offshore or foreign pension alternatives, especially if future UK residence is uncertain.

The Budget confirms that the “triple lock” for the State Pension remains intact for the duration of this Parliament. As a result, the basic State Pension and new State Pension will be uprated. (GOV.UK)

Specifically, from April 2026 pensioners will receive a 4.8% increase in their State Pension — roughly equivalent to an additional £575 per year for a full entitlement. (GOV.UK)

This is a benefit for pensioners relying on State Pension: uprating helps maintain real-income in retirement against inflation.

However — given other tax increases (on unearned income, threshold freezes) — the relative attractiveness of additional private income (dividends, savings) diminishes.

For British retirees living abroad but still eligible for State Pension: the uprating is positive. However, other Budget changes (especially around pension contributions, NI, taxes on unearned income if UK-sourced) make UK retirement less tax-efficient, depending on domicile/residence and taxation treaties.

If expats planned to use offshore incomes or foreign pensions, they must review their entire retirement income mix under the new UK rules.

If you are nearing retirement: run “post-Budget” cash-flow models to see how State Pension increases combine with other income sources in real terms.

For expats: evaluate home country taxation, UK withholding, double-taxation treaties, and whether exposure to UK pension / investment income remains optimal.

I Suggest a diversified retirement income strategy — combining State Pension, private pensions, foreign pensions/investments — rather than relying solely on UK-sourced income.

The 2025 Budget confirms the freeze on many personal tax thresholds — likely including those relevant for long-term estate planning (personal allowances, bands) though no explicit IHT threshold change was widely publicised. (Financial Times)

The Budget summary and documents do not appear to implement major reforms to relief regimes such as Agricultural Property Relief (APR) or Business Property Relief (BPR) — at least not yet. (farrer.co.uk)

That said, given the significant revenue needs (£26 billion target), future pressure on reliefs, thresholds, and allowances remains a realistic possibility. (Office for Budget Responsibility)

With thresholds frozen, the real value of IHT allowances erodes over time — meaning estates will become more exposed to IHT even if nominal values don’t change.

Business owners and families reliant on BPR/APR may face uncertainty: while no change yet, future budget cycles might target reliefs or tighten eligibility.

For clients with international ties (non-domiciled status, offshore trusts, cross-border holdings), the shifting tax environment raises the importance of estate structuring, domicile status review, and cross-border estate planning.

You should conduct immediate IHT reviews: assess estate value, potential IHT liability under “frozen thresholds,” and likely future trajectories.

I encourage the use of tax-efficient estate structures: gifting, trusts, inter-generational planning, and diversification (real estate, investments, foreign assets) as protective measures.

If you are a business owner: consider long-term holding strategies, review BPR/APR eligibility, and perhaps accelerate planned transfers or succession events under current rules.

If you are non-dom / international: analyze domicile status carefully; consider using legal/tax structures across jurisdictions to optimize inheritance outcomes and minimize future risk.

While not all details are yet fully public, reports suggest that the Budget reduces the attractiveness of purely cash-based saving — and shifts incentives toward investments (equities, funds) rather than cash savings. (Tax Policy Associates)

Some media commentary points to potential changes or pressure on Cash ISAs (though exact limits/changes remain to be clarified publicly). (Tax Policy Associates)

Cash-based savings for clients (especially older or risk-averse) become less appealing, given rising tax on savings income and likely lower real returns after inflation and taxes.

Investment-based vehicles (stocks, equities, funds) may become comparatively more attractive — but bring higher risk and volatility, which may not suit all clients.

Reassess savings vs investment strategy: for those with short- to medium-term horizons, cash savings may still have a role, but for long-term wealth growth/income, consider diversified investment portfolios.

For those nearing retirement or who are risk-averse: we can examine your balanced portfolios, risk-managed funds, or alternative investments (real assets, diversified global equities) rather than cash-only strategies.

For globally mobile persons: consider cross-jurisdictional investments or holding structures (offshore bonds, non-UK funds), observing compliance with domicile/residence and reporting requirements.

Given the higher taxes on dividends, savings, property income, and the pension salary-sacrifice changes, many previously tax-efficient strategies may lose their appeal. (Tax Policy Associates)

Would you like more specific details about your situation?

Date / Year | What Comes Into Effect / Watchpoint |

April 2026 | Dividend tax rates rise by 2 pp (basic & higher rates) — basic 10.75%, higher 35.75%. (Reuters) |

April 2027 | Savings interest and property-income tax rates rise by 2 pp; landlord finance-cost relief adjusted to new basic rate. (farrer.co.uk) |

From 2028 | New council-tax surcharge (“mansion tax”) on homes worth over £2 million comes into force. (MoneyWeek) |

April 2029 | Cap on salary-sacrifice pension contributions — only first £2,000 per year of sacrificed pay remains NI-exempt; above that, standard NI applies. (ftadviser.com) |

Ongoing / Medium Term (2028–2031) | Freeze on income tax and NIC thresholds remains; fiscal drag continues. (Financial Times) |

April 2026 (for pensioners) | Uprating of State Pension under “triple lock”: 4.8% increase. (GOV.UK) |

While the Budget introduced major changes now, some important areas remain uncertain. For example, although no immediate reforms to relief regimes (e.g. APR/BPR) or domicile-based reliefs were announced, future Budgets may target them given fiscal pressures.

Implementation details may change: e.g., how “high-value property” is defined for the surcharge, or how “salary-sacrifice cap” will be applied in practice (payroll software changes, exemptions, employer reactions).

For international clients, future changes to domicile, residence, and cross-border tax treaties could materially affect long-term planning.

Macro context: with forecasts projecting tax burden rising to ~ 38% of GDP by 2030-31, and slow real-income growth for households, economic stress may lead to further reform in coming years. (Office for Budget Responsibility)

The 2025 Autumn Budget represents a significant inflection point for UK tax policy: rather than raising headline tax rates, the government has chosen to raise revenue by freezing thresholds, increasing tax on unearned income, capping tax-efficient pension contributions, and targeting high-value real estate. The result is a clear increase in the long-term tax burden and a notable shift in the “rules of the game” — especially for investors, pensioners, high-net-worth individuals, and expatriates.

For many clients, what was once a relatively stable and predictable UK tax and pension environment now demands proactive, strategic, long-term planning.

As a wealth-management firm advising high-net-worth and international clients:

In sum: Budget 2025 requires a paradigm shift in how UK-based, cross-border, and globally mobile clients view their wealth, retirement, and legacy planning. It is no longer sufficient to rely on “passive UK income + allowances + pensions.” Instead — diversification, timing, structure, and proactive planning will determine who comes out ahead.

If you would like guidance on tax-efficiency, retirement planning, cross-border wealth, or the specific implications for your circumstances, please contact Private Client Consultancy for a personalised advisory review.

Get notified about new articles, latest changes and much more